What is a Trading Playbook PDF?

A Trading Playbook PDF is a comprehensive document utilized by traders, detailing strategies,

market analysis, and trade management rules for consistent, profitable execution within financial markets․

These playbooks often integrate technical analysis tools like support and resistance, alongside volatility

measurement, to guide decision-making and enhance trading performance․

Essentially, it serves as a trader’s reference guide, outlining specific entry/exit points, triggers, and

position sizing, all conveniently compiled into a portable PDF format․

Definition and Purpose

A trading playbook PDF is a meticulously crafted document serving as a trader’s central repository for all strategic and analytical information․ It’s more than just a collection of ideas; it’s a formalized system designed to remove emotional biases and promote disciplined execution․

The core purpose of a trading playbook is to provide a clear, repeatable process for identifying, entering, and managing trades․ This includes detailed market analysis, outlining specific technical indicators, support and resistance levels, and volatility measurements․

Furthermore, a well-defined playbook articulates precise entry and exit points, trade triggers, position sizing rules, and risk management protocols – like stop-loss orders and profit targets․ Ultimately, it aims to transform subjective trading decisions into objective, rule-based actions, fostering consistency and improving overall profitability․

Why Use a Trading Playbook?

Employing a trading playbook PDF offers significant advantages for traders of all levels․ Primarily, it fosters consistency by establishing a pre-defined set of rules, minimizing impulsive decisions driven by market fluctuations or emotional responses․ This structured approach enhances discipline and reduces errors․

A playbook also streamlines the analytical process․ By pre-defining key indicators – such as support/resistance and volatility measurements – traders can quickly assess opportunities without re-analyzing the market each time․

Moreover, it facilitates backtesting and performance evaluation․ Traders can review past trades against the playbook’s rules to identify areas for improvement․ Finally, a well-documented playbook is invaluable for knowledge sharing within teams, particularly in hedge funds or proprietary trading firms․

Key Components of a Trading Playbook

Essential elements include detailed market analysis, specific trading plans (day, swing), clear entry/exit strategies, risk management rules, and visual aids for quick reference․

Market Analysis Section

The Market Analysis Section forms the bedrock of any robust trading playbook, providing the foundational understanding necessary for informed decision-making․ This critical component meticulously details how a trader assesses the prevailing market conditions before initiating any trade․

It encompasses both fundamental and technical analysis, though playbooks often lean heavily towards the latter, employing tools like support and resistance levels to pinpoint potential entry and exit points․ Furthermore, a comprehensive playbook will dedicate space to measuring market volatility, recognizing that risk parameters shift dynamically with changing conditions․

Understanding these elements allows traders to identify potential opportunities and mitigate risks effectively, aligning trades with the broader market trend and increasing the probability of success․ This section is not static; it should be regularly updated to reflect evolving market dynamics․

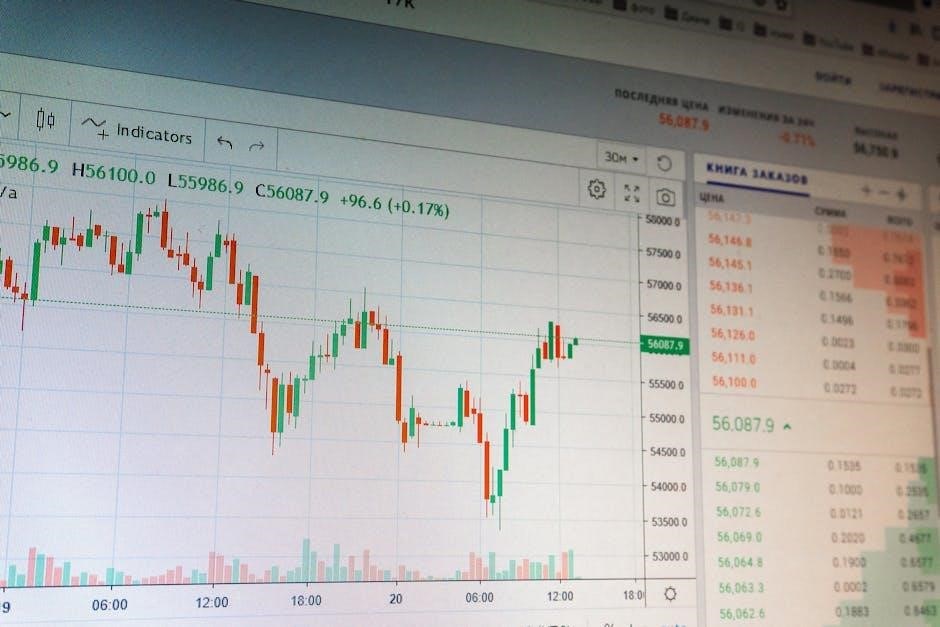

Technical Analysis Tools

Technical Analysis Tools are integral to a trading playbook, providing methods to evaluate assets by analyzing past market data, primarily price and volume․ Common tools include identifying support and resistance levels – price points where the price tends to find support or face resistance – crucial for potential entry and exit strategies․

Furthermore, playbooks often incorporate chart patterns like trend lines, head and shoulders, or flags, offering visual cues for potential trading opportunities․ Indicators such as Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are frequently utilized to confirm trends and identify overbought or oversold conditions․

The effective application of these tools, clearly defined within the playbook, empowers traders to make data-driven decisions and refine their trading strategies․

Support and Resistance Levels

Support and Resistance Levels are fundamental concepts within a trading playbook, representing key price points where the price tends to pause or reverse․ Support is a price level where buying pressure is strong enough to prevent the price from falling further, acting as a ‘floor’․ Conversely, Resistance is a level where selling pressure overcomes buying pressure, halting price increases and forming a ‘ceiling’․

Identifying these levels is crucial for setting potential entry points – buying near support and selling near resistance․ Playbooks detail methods for pinpointing these levels using historical price data and chart analysis․

Breakouts – when the price moves decisively through a support or resistance level – are also key signals, often indicating a continuation of the trend․ Understanding and utilizing these levels enhances trade precision․

Volatility Measurement

Volatility Measurement is a critical component of a robust trading playbook, assessing the degree of price fluctuation in a financial instrument․ Higher volatility signifies greater price swings, presenting both increased risk and potential reward․ Playbooks often incorporate tools like Average True Range (ATR) or standard deviation to quantify volatility․

Understanding volatility informs position sizing; higher volatility typically necessitates smaller positions to manage risk․ It also influences the placement of stop-loss orders, requiring wider buffers during volatile periods․

A well-defined playbook outlines how to adapt trading strategies based on current volatility levels, recognizing that strategies effective in calm markets may fail during high volatility․

Trading Plan Types

Trading Plan Types within a playbook cater to different time horizons and risk appetites․ Day Trading Playbooks focus on exploiting intraday price movements, requiring rapid execution and tight risk management․ These plans detail specific entry and exit rules based on short-term technical indicators․

Conversely, Swing Trading Playbooks aim to capture profits from price swings spanning several days or weeks․ They emphasize identifying prevailing trends and entering trades in their direction, with strategies for managing potential reversals․

A comprehensive playbook may include variations like scalping or position trading plans, each with tailored rules for market analysis, trade execution, and risk control․

Day Trading Playbook

A Day Trading Playbook is designed for capitalizing on short-term price fluctuations, closing all positions before the market closes․ It necessitates a high degree of discipline and quick decision-making․ Key components include pre-market scanning for volatile stocks and identifying intraday support and resistance levels․

Effective day trading playbooks outline precise entry and exit triggers, often based on technical indicators like moving averages, RSI, or MACD․ Risk management is paramount, with strict stop-loss orders to limit potential losses․

These playbooks often detail specific chart patterns to watch for and strategies for managing winning trades, including trailing stops and profit targets․ Successful day traders meticulously follow their playbook’s rules․

Swing Trading Playbook

A Swing Trading Playbook focuses on capturing price swings that unfold over several days or weeks․ It’s geared towards traders who can’t constantly monitor the market, unlike day traders․ Identifying the prevailing trend is crucial; swing traders aim to enter trades with the trend․

These playbooks detail methods for pinpointing optimal entry points during pullbacks or consolidations within the larger trend․ Recognizing signals indicating potential trend failure or reversals is equally important, triggering exit strategies․

Effective swing trading involves utilizing technical analysis to define support and resistance levels, and employing volatility measurements to gauge risk․ Position sizing and stop-loss orders are vital for protecting capital․

Developing Your Trading Strategies

Crafting strategies involves identifying market trends, defining precise entry and exit points, and establishing clear trade triggers based on signals and analysis․

Identifying Market Trends

Accurately pinpointing market trends is foundational to a successful trading playbook․ This involves a multi-faceted approach, combining technical and potentially fundamental analysis․ Traders often utilize charting techniques to visually identify higher highs and higher lows – indicative of an uptrend – or lower highs and lower lows, signaling a downtrend․

Furthermore, understanding trend strength is crucial․ A strong trend exhibits consistent momentum, while a weakening trend may present opportunities for reversal strategies․ Playbooks should detail specific indicators, such as moving averages or trendlines, used to confirm trend direction and strength․ Recognizing these patterns allows traders to align their strategies with the prevailing market sentiment, increasing the probability of profitable trades․

Swing trading playbooks, in particular, emphasize identifying the dominant trend to enter trades in its direction․

Entry and Exit Points

Defining precise entry and exit points is paramount within a trading playbook․ Entry points are often determined by identifying key levels of support and resistance, or utilizing technical indicators to signal optimal entry timing․ A playbook should clearly articulate the criteria for initiating a trade, minimizing impulsive decisions․

Equally important are exit strategies․ Does the playbook advocate exiting 100% of a position at the target, or a partial mitigation approach? Should stop-loss orders be adjusted as the trade evolves? These rules must be pre-defined․ Successful playbooks detail specific profit targets and stop-loss levels, based on risk tolerance and market volatility․

Clear entry and exit rules are vital for consistent execution and effective trade management․

Trade Triggers and Signals

Trade triggers and signals form the core of a reactive trading strategy, detailed within a robust playbook․ These are pre-defined conditions that initiate or terminate a trade, removing emotional bias․ Signals can stem from technical analysis – like moving average crossovers or candlestick patterns – or fundamental events․

A well-defined playbook will illustrate specific trigger setups with visual examples, acting as a “cheat sheet” for quick reference․ For instance, a long trade example might detail a trigger based on a breakout above a resistance level․ Crucially, the playbook should also outline signals warning of potential trend failure or reversals, prompting protective action․

Clear triggers ensure disciplined execution and adherence to the overall trading plan․

Trade Management Strategies

Effective trade management, detailed in a playbook, encompasses position sizing, strategic stop-loss orders, and precise profit targets for maximizing gains and minimizing risk․

Position Sizing

Position sizing is a critical element within a trading playbook, dictating the appropriate amount of capital allocated to each trade․ It’s not simply about risking a fixed dollar amount; rather, it’s a calculated approach based on risk tolerance, account size, and the potential reward-to-risk ratio of the setup․

A common guideline involves risking only a small percentage – often 1% to 2% – of total trading capital on any single trade․ This protects against significant drawdowns during losing streaks․ The playbook should clearly define the position sizing formula or rules used, ensuring consistency and discipline․

Factors like volatility and the trader’s confidence level in the setup should also influence position size․ Larger positions may be considered for high-probability setups with favorable risk-reward profiles, while smaller positions are appropriate for uncertain or lower-conviction trades․

Stop-Loss Orders

Stop-loss orders are fundamental risk management tools detailed within a trading playbook, designed to automatically exit a trade when it moves against the trader’s position․ They limit potential losses and protect capital, a cornerstone of consistent profitability․

The playbook should specify precise stop-loss placement strategies, often based on technical levels like support and resistance, swing lows/highs, or Average True Range (ATR) calculations․ A rigid rule, such as placing stops a specific ATR multiple away from the entry point, promotes objectivity․

Crucially, the playbook should address whether stop-loss orders are adjusted as the trade evolves․ Some strategies advocate trailing stops to lock in profits, while others maintain fixed stops․ Clear guidelines prevent emotional decision-making and ensure adherence to the plan․

Profit Targets and Exits

Profit targets and exit strategies are critical components of a trading playbook, defining when to secure gains and maximize returns․ The playbook must detail clear criteria for exiting winning trades, preventing over-optimism and protecting realized profits․

Targets can be based on fixed risk-reward ratios (e․g․, 2:1 or 3:1), key technical levels like resistance, or Fibonacci extensions․ The playbook should also outline scenarios for partial profit-taking – scaling out of positions as targets are hit – to reduce risk and lock in gains․

Furthermore, it should address whether to exit 100% of the position at the target or employ a mitigation approach․ Consistent application of these pre-defined exit rules is vital for disciplined trading and long-term success․

Creating a Combined Playbook and Trade Planner

A combined playbook and trade planner consolidates setups, strategies, and visual examples into a single, accessible file for quick reference before trade execution․

Storing Setups and Strategies

Efficient storage of trading setups and strategies is a core function of a combined playbook and trade planner․ This involves meticulously documenting each approach, including detailed descriptions of the market conditions where it performs optimally․

Crucially, the planner should incorporate visual aids – screenshots of chart patterns, key indicator configurations, or annotated examples – to facilitate rapid recognition and execution․ Think of it as a ‘cheat sheet’ for consistent application․

Categorizing setups by market type (trending, ranging, volatile) or asset class further enhances usability․ The goal is to create a readily searchable database of proven strategies, minimizing hesitation and maximizing the probability of successful trades․ Regularly updating this repository with new learnings is essential․

Visual Examples and Cheat Sheets

Integrating visual examples is paramount within a trading playbook PDF․ Charts displaying ideal entry and exit points, annotated with key indicators and price levels, dramatically improve comprehension and recall․ These aren’t just static images; they’re quick references for real-time decision-making․

Cheat sheets summarizing critical rules – position sizing guidelines, stop-loss placement strategies, or volatility thresholds – provide instant access to essential information during fast-paced trading sessions․

Consider including checklists for trade setup verification, ensuring all criteria are met before execution․ A well-designed playbook leverages visual cues and concise summaries to streamline the trading process, reducing cognitive load and promoting disciplined execution․

Target Audience for Trading Playbooks

Trading playbook PDFs cater to diverse professionals, including hedge fund managers, proprietary traders, and investment bank specialists seeking structured,

repeatable trading processes․

Hedge Funds

Hedge funds extensively utilize trading playbooks to standardize strategies across portfolio managers and analysts, ensuring consistent risk management and execution․ These PDFs provide a framework for implementing complex trading ideas, often involving quantitative models and algorithmic trading․

Playbooks help maintain discipline, especially during volatile market conditions, by predefining entry and exit rules, position sizing, and stop-loss levels․ They facilitate knowledge sharing and onboarding of new team members, accelerating the learning curve and promoting a unified approach to trading․

Furthermore, detailed playbooks are crucial for audit trails and regulatory compliance, demonstrating a systematic and well-documented trading process․ The structured format allows for performance analysis and continuous improvement of trading strategies within the fund․

Proprietary Trading Firms

Proprietary trading firms (prop firms) heavily rely on trading playbooks as core components of their trading infrastructure․ These PDFs are essential for scaling profitable strategies and managing risk across a team of traders utilizing firm capital․ Playbooks define specific trading setups, including technical indicators, entry/exit criteria, and risk parameters․

Prop firms often emphasize strict adherence to playbook rules, fostering a disciplined and systematic approach to trading․ This standardization minimizes emotional decision-making and ensures consistent execution․ Detailed playbooks also facilitate performance evaluation, allowing firms to identify and replicate successful strategies․

Moreover, playbooks serve as valuable training materials for new traders, accelerating their development and integration into the firm’s trading environment․ They are vital for maintaining a competitive edge in fast-paced markets․

Investment Banks

Investment banks utilize trading playbooks, though often with a different focus than prop firms․ While profitability remains key, playbooks within investment banks frequently center on facilitating client orders and managing the bank’s own risk exposure related to market-making activities․ These PDFs detail strategies for hedging positions and capitalizing on arbitrage opportunities․

Playbooks in this context often incorporate sophisticated quantitative models and risk management protocols․ They outline acceptable trading ranges, position limits, and escalation procedures for unusual market events․ Compliance and regulatory considerations are heavily integrated into the playbook structure․

Furthermore, investment banks employ playbooks to standardize trading processes across different desks and regions, ensuring consistency and control․ They are crucial for maintaining market integrity and adhering to strict regulatory guidelines;

PDF Format Advantages

PDFs offer portability, accessibility across devices, and enhanced security for sensitive trading strategies․ Version control is simplified,

ensuring traders always use the most current playbook iteration․

Portability and Accessibility

A key benefit of utilizing the PDF format for a trading playbook lies in its exceptional portability․ Traders aren’t confined to a desktop computer; they can access crucial strategies and analysis on smartphones, tablets, or laptops, facilitating informed decisions regardless of location․ This accessibility is paramount for those actively monitoring markets or executing trades remotely․

Furthermore, PDFs maintain consistent formatting across various operating systems and devices, ensuring the playbook appears as intended, without rendering issues․ This eliminates potential confusion arising from differing software interpretations․ The widespread availability of free PDF readers further enhances accessibility, removing software cost barriers for traders․ Essentially, a PDF playbook empowers traders with readily available, reliable information, anytime and anywhere․

Security and Version Control

Employing the PDF format offers inherent security advantages for sensitive trading playbooks; PDFs can be password protected, restricting access to authorized personnel only, safeguarding proprietary strategies from unauthorized distribution․ This is particularly crucial for firms dealing with high-value trading information․

Moreover, PDFs facilitate robust version control․ Each iteration of the playbook can be saved as a new PDF file, maintaining a clear audit trail of changes and allowing traders to revert to previous versions if needed․ This prevents accidental overwrites or loss of valuable insights․ The ability to digitally sign PDFs further enhances security and authenticity, confirming the document’s origin and integrity; This controlled evolution ensures strategies remain current and reliable․

Legal and Ethical Considerations

Trading playbook PDFs must disclose potential conflicts of interest and ensure transparency in practices, adhering to regulatory standards and ethical trading conduct․

Disclosure of Potential Conflicts of Interest

A crucial ethical component of any trading playbook, particularly those shared or sold, centers around transparently disclosing potential conflicts of interest․ Authors or firms creating these playbooks may have vested interests in specific financial instruments discussed within․

For instance, an author advising on trades could directly or indirectly hold positions in those same assets, influencing their recommendations․ Full disclosure is paramount; users must be informed if the playbook creator benefits from the success – or is unaffected by the failure – of suggested trades․

This includes revealing any affiliations with brokers, exchanges, or companies mentioned, ensuring users can assess the objectivity of the playbook’s strategies․ Failing to disclose such conflicts erodes trust and potentially violates regulatory guidelines․

Transparency in Trading Practices

A cornerstone of ethical trading, and vital within a trading playbook PDF, is complete transparency regarding the strategies employed․ The playbook should clearly articulate the rationale behind each trade setup, detailing the specific indicators, patterns, and market conditions triggering entry and exit points․

Vague or overly complex explanations breed distrust and hinder a trader’s ability to understand and adapt the playbook․ Detailed record-keeping of all trades executed based on the playbook is also essential, allowing for performance analysis and identification of areas for improvement․

Furthermore, transparency extends to risk management; the playbook must explicitly outline position sizing, stop-loss placement, and profit-taking strategies, fostering responsible trading habits; Openly communicating these practices builds confidence and accountability․